Buying off the plan means buying a property that has yet to be built or is still under construction. Your decision is based on the building plans and designs, rather than the completed structure. This article provides a concise summary on the key points and implications involved

Key Points to Consider

- Sunset Dates: Every contract includes a “sunset date”, which is the deadline by which the developer must register the plan for the purchase to proceed. This protects purchasers, preventing them from being tied to a property for an indefinite period, and enabling them to withdraw and reclaim their deposit if necessary.

- Settlement Timeframe: Following registration, it is crucial to negotiate for a settlement timeframe of ideally 14 to 21 days, to allow sufficient time to finalise loans and finance, and complete legal procedures

- Variations: A developer can amend a draft plan attached to the contract for sale. Off the plan contracts contain a condition that limits development changes to what is reasonably necessary. For example, the property’s area/size is typically restricted to a fixed percentage decrease of 5% from the initial plans

- Goods and Services Tax (GST) and Capital Gains Tax (CGT): The purchaser must withhold a portion of the purchase price on the developer’s behalf, for the developer to pay GST and CGT. It is the purchaser’s responsibility to ensure compliance by the developer, and to subsequently remit the payment to the ATO.

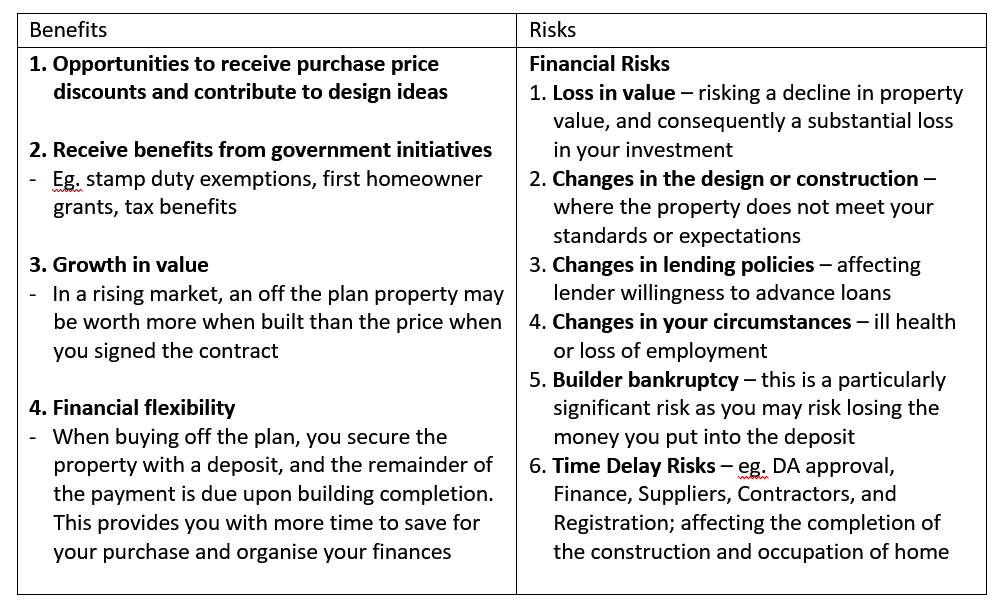

Benefits and Risks

How we can assist

- Carry out legal due diligence and ensure the client makes an informed decision

- Thoroughly review proposed contracts and negotiate for the best protection for the purchasers, so there is no unfair advantage for the developer

If you or someone you know wants more information or needs help or advice, please call 02 9150 6991 or email ad***@**********om.au

Important Disclaimer: This content contains general information for reference purposes only. If you are considering buying off the plan and entering into a contract, we strongly recommend obtaining professional legal advice tailored to your circumstances.